Modern technology has made massive improvements in recent years, making it easier for people to invest their money. Investing is a great way for people to earn a passive income, requiring little work to earn additional money.

Due to the current market, more people look to earn extra money to help pay their bills. If you are one of those then investing might be for you. Thanks to modern technology, it has made it easier to invest as you can download apps on your phone to invest in stocks and funds.

Let’s look at some of the most common apps that you can use in 2023.

Freetrade

Freetrade is the first app on the list and this is one that many people start their investing careers. The reason why this is a common choice in the Uk is because it is commission free. As a first-time investor making small investments, you don’t want to be charged a commission for each investment.

Another great positive to Freetrade is that you can invest in several small to large-cap stocks in the US and the UK. You can also invest in some stocks in the German, Dutch and Finnish markets.

Freetrade has three different versions as well. You have the basic version, the standard version and the plus version. Read into these versions to find which suits you best before you invest.

eToro

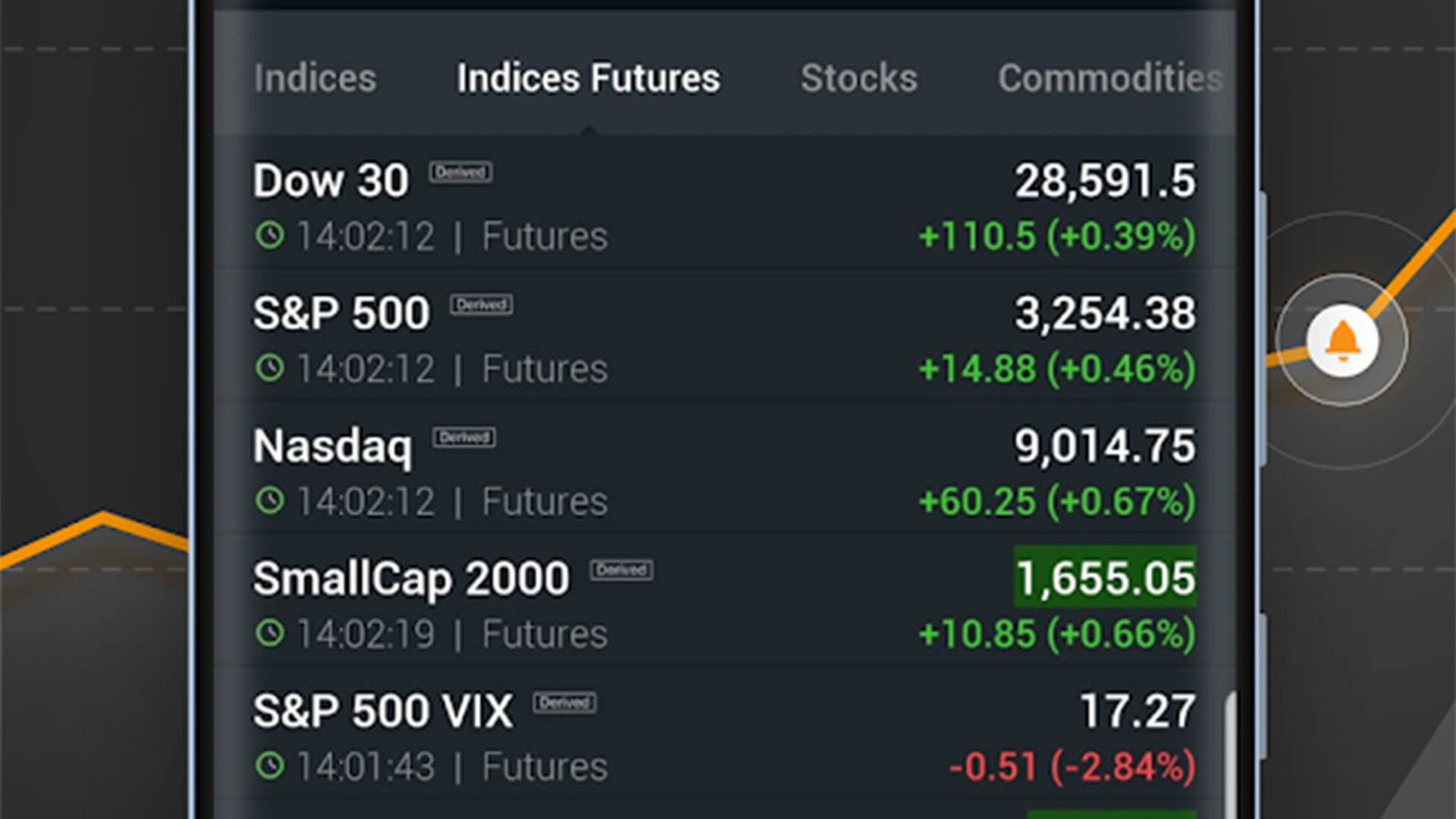

eToro is another great investment app for beginners. This app helps you invest in traditional stocks as well as modern investments such as cryptocurrency. Cryptocurrency is becoming very normal for the younger generation to invest in which is why eToro allows you to invest in this market as well.

A positive to investing with eToro is that you can be protected from most scams. As they are a regulated broker, it ensures the safety of your investment.

Another benefit to eToro is that you can follow other investors there to see what they are investing in.

Trading 212

There are many positives with Trading 212 which is why it is one of the most popular trading apps in the UK. Furthermore, it is a great app for people to practise without investing any of their money. All you need to do is switch over to the practice account and start investing with the £5,000 that Trading 212 gives. This money isn’t real so you don’t need to worry about paying it back at all. Just use this money to gain enough experience on the market and learn the basics of investing.

To Conclude

As you can see, there are many apps to invest your money. To get your practice in, we advise you to use Trading 212 as you don’t need to invest any of your money. It is free to use and doesn’t charge a commission on your investments when you start investing your money.

Before investing your money into any stocks, you must make yourself aware of investment scams. Due to the popularity of cryptocurrency and NFTs, it is more common to be a victim of crypto and NFT fraud. Make sure you are safe and invest with regulated brokers to ensure the safety of your money.